We found this recent survey by GoBankingRates.com very fascinating and motivating. As an investment services company, these results were interesting to look over, and we wanted to share them with our members and readers!

If you are struggling to grow your savings or worry about how much you have saved, you are not alone. GoBankingRates.com interviewed about 5,000 internet users and found that 62% of Americans have less than $1,000 in savings! Granted this may exclude any investment or retirement accounts, but still this number is an eye opener.

It means there may not be enough to cover any emergencies that arise. Many end up relying on family, friends, credit cards, or even borrowing on their retirement funds (a 401k no-no) to meet financial needs.

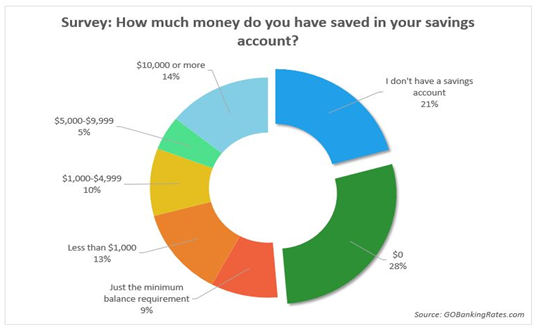

As the graph above shows, a shocking 49% of us don’t have a savings account or savings at all. Only 14% of us have $10,000 or more in savings.

They took their survey results a little further to see if age or gender played any role in these saving trends.

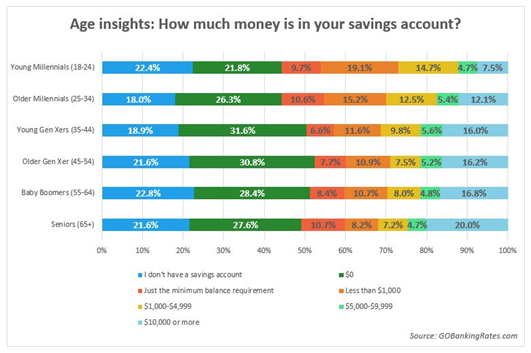

As might be expected, the group that has the most saved are seniors (age 65 plus) followed by Baby Boomers and Generation X. These are ages 35 to 65. Clearly the older you are, the more you do tend to have a savings. Age has to count for something! What about gender differences?

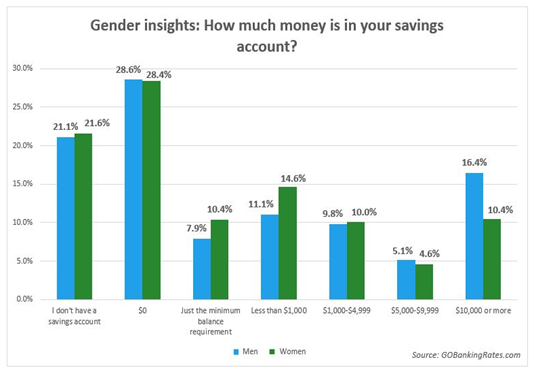

Have you ever questioned whether genders affect the way people save? This graph may shed some light on that answer. The results show that in the categories from no account to zero in savings, gender does not seem to be a factor. But women take the (not so major) lead in the categories from$ 0 to $1,000 in savings. The big percentage difference between the genders is indicated by the category $10,000 or more, where men savers take a lead over women savers.

Here at 401k Selections, we know how crucial savings funds are to your financial health. That is why we make it our goal to provide you with the key information needed to help you make the most of your investments! We hope you enjoyed today’s blog. Don’t forget to like us on Facebook and/or connect with us on Linkedin for Future updates and savings.