Are you considering borrowing from your 401k? In the past, we have mentioned that taking loans from your 401k is not always the best decision. Although 401k loans can be a costly mistake, there is always a silver lining. Before you make a decision, consider these pros and cons.

Pros:

- Convenience- In a world where importance of convenience is always increasing, it is an obvious pro for any decision. No credit checks or long applications! Depending on your plan, you can apply for your loan with a phone call, short form, or even online. Avoiding the hassle of a traditional type of loan is a huge plus for deciding to borrow from your 401k. Minimal other restrictions and quick availability are added bonuses that come with borrowing from your account.

- Low Interest Rates- Interest rates and loans come hand-in-hand, but 401k loans typically have a lower interest rate that is set by the plan.

- Paying Interest to Yourself- With a traditional loan, you pay the interest to the bank or credit card company. With a 401k loan, you pay yourself the interest back into your account.

Times to Consider a 401k Loan:

- You need a small, short-term loan that you will be able to pay off quickly

- You have an emergency situations (i.e. medical)

- You considered all other options

In the words of Shakespeare, “What’s in a name? that which we call a rose By any other name would smell as sweet”. It is clear there are advantages to 401k loans, but a 401k loan is still a loan. Just as with a traditional loan, you enjoy the benefit of upfront money, so this heightens the importance of the disadvantages related to borrowing from your 401k.

Cons:

- Opportunity Costs- Consider all your costs before borrowing from your 401k account. Although the interest earned from your 401k loan is ultimately going straight back to your 401k account, this is often much less than the amount that would have been earned if the funds would have stayed invested in your 401k. When these funds are borrowed, any potential gains are automatically lost because they have been removed from further investment in the market. Another aspect to be aware of is that companies do not match the amount you pay towards the loan.

- Employment Obstacles- When deciding whether or not to take out a 401k loan, be sure you plan to stay employed with your current employer. If you decide to change employers, quit working, or if your employer terminates your employment, there is a likely chance that your 401k loan will be expected to be paid in full almost immediately (60 days is a common time frame). Whether it is a voluntary or involuntary employment shift, it can potentially cause a time of financial strain. Not only is your income ceased momentarily, but you are forced to use your funds to pay off your 401k loan. This increases the risk of landing your 401k loan in default, and this may trigger additional costs in the form of taxation and penalty fees.

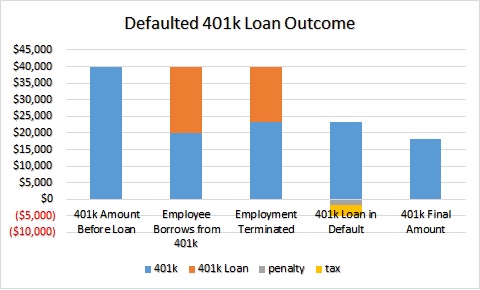

(The graph below illustrates the change in your 401k savings if a 401k loan can’t be paid back in time: An employee has $40,000 in their 401k account, and they borrow a $20,000 to be paid in 5 years with a 5% interest rate. Let’s assume after one year the employee is terminated. At this time, the employee still owes about $16,700.00 on the 401k loan. This individual is unable to pay the loan back in time and is now considered in default. Not only is the outstanding loan balance subject to current income taxes (assuming a 20% bracket), but also there is a 10% penalty fee on the amount outstanding. This creates penalty dues of $5,010. Assuming that impact on the 401k, the end result is that this individual has gone from $40,000 to $18,290 in their 401k account).

- In the End- A portion of your contributions made to your 401k account will be used to pay off your loan. As a result, you are contributing less overall for your retirement. Unless you are including extra funds as a contribution on top of what you are paying back to your 401k account, your future retirement is impacted.

Times to Avoid:

- If you plan to leave your current employment

- If your job security is questionable

- If you are nearing retirement

- If you are not able to add contributions on top of paying back your loan

Due to the importance a 401k account plays in your future financial wellness, it is best to think of a 401k loan as your last resort option.

Although there are personal influences that will contribute to whether or not a 401k loan is the best option for your financial situation, knowing the advantages and disadvantages of your choice is a great place to start!

We would like to know your thoughts or questions about 401k loans in the comments below or email us at info@401kSelections.com for more information!